Welcome to 2023: Your Business Guide to Surviving and Thriving the Year Ahead

PGP Advisory certainly hopes you had a joyous holiday season and a Happy New Year. As we enter into 2023, here are some of the challenges we anticipate and our strategic advice on how to combat and prepare for what may be a rocky and windy road ahead.

How to Prepare for Business Challenges in 2023

Reflecting on 2022

Business owners have faced huge challenges and undergone an incredible amount of change over the past few years, and this won’t slow down in 2023. Businesses will have to deal with the aftereffects of the global pandemic, Russia’s invasion of Ukraine, economic challenges, as well as an ever-faster development of technologies.PGP Advisory has several years experience of ongoing change and evolution of the industry. Below are key challenges to watch out for in the new year and insights into how business owners can prepare for obstacles they may face in 2023.The Looming Recession

As a recession for 2023 is likely probable, entrepreneurs will need to begin preparing their businesses now for the challenges ahead. Sales could slump, budgets could tighten, and securing capital could become a lot harder. Entrepreneurs will need to adjust their expectations from the big venture deals of the past decade.

How to Respond: PGP Advisory highly suggests meeting with your accountant. Now, is the time to audit your books and ensure you have the cash reserves to weather the bad times. Accounting can be an afterthought for new founders, PGP Advisory recommends hiring a third party to audit your books. Business owners should also consider auditing their processes too. When a company is in a high-growth stage, it might adopt ad-hoc systems that are fine for the moment but will need to be revamped in slower months to be sustainable and efficient.

Downturns in Sales

Business owners will likely continue to deal with price adjustments well into 2023. Inflation and interest rates often indicate how willing people are to spend. Consumers are shifting their focus to items they deem essential and highly valuable.

How to Respond: Business owners should consider adapting their business model or figure out the right pricing structure so they can continue to survive. This is a great opportunity to connect with customers to understand their needs. Perhaps there are new avenues for sales opportunities to explore.

Employee Retention, Engagement and Productivity

We’ve been hearing about the “War for Talent” for years, but now it feels like the war is deepening. Companies across industries are facing massive gaps for vital future skills, and they will need to re-skill or up-skill massive sections of their workforce to get ready for the 4th industrial revolution. On top of that, the pandemic has made many people reevaluate their jobs, leading to mass resignations in many sectors.

How to Respond: Create clear channels where employees can raise concerns and health issues. Stay up to date with emerging issues. Perhaps your business can allow flexible working hours to allow employees to attend to personal issues. Encourage employees to keep strict working hours to avoid the common burnout issue. Find out what you can provide for employee mental health support. Additionally, taking steps like hiring people straight out of school, employing low-code or no-code software for critical needs, and instilling cultures of continuous learning.

Accelerated Digital Transformation

Artificial intelligence (AI) is already starting to augment all of our businesses, and that trend will continue to accelerate next year. This is rapidly creating a world of ever-faster technological developments.

How to Respond: Every business must think of itself as a tech business. Companies need to re-design their processes and ensure their people have the skills needed for a world where we increasingly collaborate with and work alongside capable and intelligent machines.

Summary – Stay Flexible

It’s important to keep in mind that there will always be unexpected disruptions in our lives. Businesses should plan for these disruptions and make sure everyone knows how to respond when things go wrong. These unprecedented challenges provide opportunities to stay flexible in the months ahead. The most successful businesses, will be those that adapt quickly.

Valuation. Strategy. Results.

At PGP Advisory, we always emphasize the significance of valuation. Even if you have no plans to sell, intentionally adding value is one of the best ways to strengthen your business and protect yourself from unforeseen events. We work with clients in San Antonio, Austin, Atlanta and beyond. No matter where your business is located, life throws curve balls. Our experienced team of professional business brokers in San Antonio, knows what buyers look for in a business. The factors that result in a premium sale price are inherently good for day-to-day business. Our unique advisory service starts with a valuation and business analysis. We identify strengths and weaknesses, then we develop a realistic strategy designed to add value, streamline operations, reduce owner dependency, and increase profitability. We draw on academia, years of experience, and a deep understanding of what makes a well-rounded business broker in San Antonio. Implementing best practices early will result in a more efficient and profitable business that is ready to sell when the time is right. By planning in advance you are much more likely to achieve your financial goals.

- We offer a free automated valuation to get started. You will receive a broad perspective on your business’s potential value. Click here to proceed.

- Click here to schedule your free custom consultation. During this meeting, we’ll be able to provide more comprehensive insights about your business and its current worth.

- PGP Advisory also offers a more robust and detailed valuation model. Click here if you’d like to get started with a more in-depth business valuation that takes into account additional factors, such as your market.

Business valuations can highlight strengths and weaknesses, and expose opportunities for improvements to add value. Many of our San Antonio, Austin and Atlanta clients use their business valuation results to build and help locate new opportunities. Contact us today if you would like to discuss setting up your valuation and the most appropriate option for you.

Read More

How Can You Tell If a Potential Buyer is Really Serious?

When you’re trying to sell your business, the last thing you want is to waste time dealing with buyers who aren’t qualified and are unlikely to actually make a purchase. After all, you will not want to reveal details about your business to someone who may be looking to take advantage of the situation. Let’s take a closer look at how you can weed out legitimate buyers from those who are just kicking the can down the road.

Legitimate buyers will ask the right questions. They will have a keen interest in your industry and are seeking to gain more information. They will also be likely to ask intelligent probing questions about your customer base and the strengths and weaknesses of your business.

The best buyers will also ask logistical questions about your inventory and cash flow. It goes without saying they will want to know details about profits that are generated. Real buyers will also be concerned about wages and salaries. Their goal will be to ensure that your employees are taken care of and will be unlikely to quit.

Another area that you can expect serious buyers to ask about is capital expenditures. They will evaluate any equipment and machines involved in the business. They will also likely inquire about inventory that is unusable due to the fact that it is outdated or problematic. After all, if they are truly planning to buy the business, they would inherit any headaches.

A good rule of thumb is to imagine yourself in the shoes of the prospective buyer. What kinds of questions would you ask? If you find that a buyer is only asking the bare minimum of questions that only scratch the surface, odds are that they are not really interested. You can expect the legitimate buyer to ask about everything from environmental concerns to details about your competitors.

The best way to evaluate buyers is to turn to the experts. Your Business Broker or M&A Advisor will have years of experience in talking to buyers and will have a leg up on evaluating who is worth your time and energy.

Further, you would likely be overwhelmed with the process of handling buyer inquiries while you are still trying to effectively run and manage your business. A good brokerage professional will handle your incoming inquiries and only notify you of buyers who are suitable, qualified candidates. They will ensure that the highest standards of confidentiality are held along the way.

Copyright: Business Brokerage Press, Inc.

The post How Can You Tell If a Potential Buyer is Really Serious? appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

Celebrate 2021 & Look Ahead to 2022 With PGP Advisory

Taking Your Business to the Next Level

We unlock value for owners by helping you prepare for and successfully sell your business. We guide entrepreneurs through the exit process from evaluating options through closing the transaction. PGP Advisory also advises individuals and businesses seeking to grow through acquisition. We are an M&A Advisory firm and Business Broker in San Antonio who works with clients of various sizes across a wide range of industries and geographies. We are excited to support your 2022 exit or acquisition goals!

Looking Back on 2021

Thank you for your contribution toward our success last year. Here’s a summary of what we accomplished:

Crushed Goals in 2021

- Software Consulting Firm Acquisition (Sell-Side Advisor)

- FedEx Trucking Acquisition (Buy-side Advisor)

- Kickboxing Gym Acquisition (Sell-side Broker)

- Flower Store Acquisition (Sell-side Broker)

Total Closed Deal Value: $2.3M

Increased Our Scope

- Executed a strategic partnership with Transworld Business Advisors of Atlanta Peachtree to provide brokerage services in the Georgia market.

- In negotiations with a strategic partner to support M&A Advisory work in Charlotte, NC.

- Working with a partner who assesses business cost-out opportunities. Click here to learn more.

We Remain Committed to:

- Supporting clients through successful merger and acquisition transactions.

- Educating and preparing business owners for successful exits.

- Connecting owners with the resources to increase cash flow and the value of their businesses.

Hyper-Focused on Challenges Ahead

PGP Advisory is here to help you navigate the M&A landscape in the face of obstacles, such as:

- Talent retention in a tight labor market.

- Product availability during supply chain disruptions.

- Input costs and margins in an inflationary environment.

- Debt levels, capital investments, and available deal capital amidst rising interest rates.

Your Business Journey

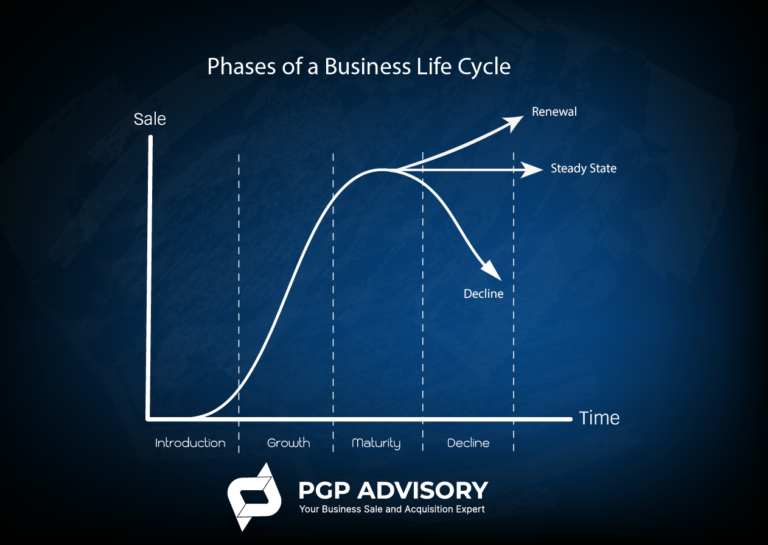

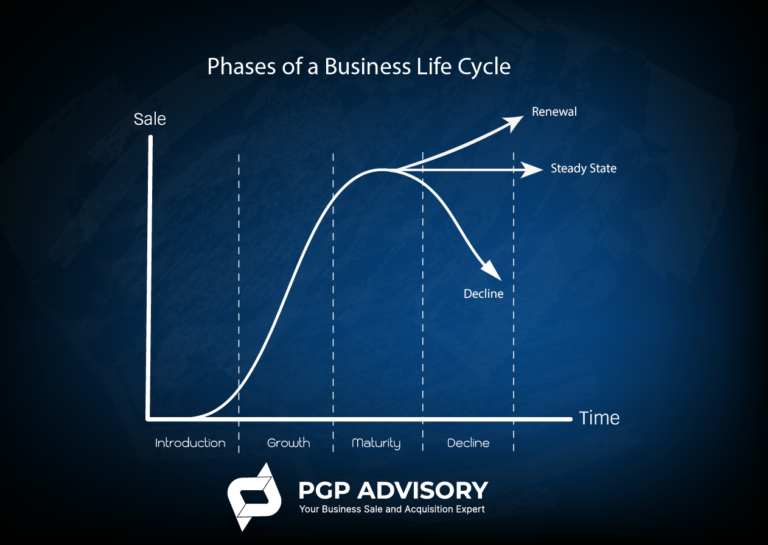

Regardless of where you are in your business journey (growth, maturity, exit), it’s important to focus on increasing the value of your business (i.e. growing operational cash flow). It is the lifeblood for growth, the discretionary income to support personal expenses, retirement, etc., and the driver of your business’ exit value.

Can you identify where your business lands in the life cycle chart?

More in Store for 2022

Be on the lookout for more content from us. PGP Advisory will continue to keep you informed on trends, information and challenges that impact your business. Let our team of trusted advisors help you crush your business goals this year and beyond.

Interested in learning more about the sale process? Download a free white paper here.

Schedule a consultation for your business valuation here.

Read More