Why Your Business Should ALWAYS Be Ready To Sell

Whether you have exit strategies in place or you plan to operate your business for a long period of time, as an entrepreneur, you should always be ready to sell your business. Many owners of private businesses fail to recognize the importance of running their companies in a way that ensures they are fully prepared should the need to sell arise.

Based off experience helping countless business owners reposition and restructure their businesses, PGP Advisory always encourages clients to the adopt the prepared mindset of ‘always be ready to sell,’ even if they have no intention of selling. Our goal today is to demonstrate how always being ready to sell will position your company for success regardless of where you are on your business journey.

Be The Buyer

Let’s begin by placing ourselves in the position of a prospective investor. A savvy business investor will want to see a well-oiled, automated, documented, efficient, and streamlined machine when they look under the hood.

Potential buyers almost always can see through a rushed attempt to make a business seem as though it’s running at its full potential. Failing to put solid financial systems in place or to make sure key management team members are fully capable of leading when you’re not around is like waiting until the week before your child graduates from high school to research college admissions requirements. Simply put, it’s too late.

Most sellers do not consider buyer needs until a sale is imminent, which often results in them scrambling to make changes or accepting a reduced sale price.

Prepare to Sell, Even If You Don’t

Ready to sell, does not mean your business has to be on the market. It means that if a sale arose, or circumstances change, your business will immediately be more attractive to buyers. The intention here is that by being ready to transition to a new owner, putting solid systems in place, employing great staff and reducing reliance on the you as an owner, will inevitably ensure you get the best price when it is time to sell. This also means that it becomes easier to run your business and you can spend more time working on your business instead of in it. At times, forces beyond our control (e.g. COVID-19, economic recessions, difficulty accessing capital, rising rates, etc.) may affect the timing of your decision. Many sellers took advantage of the premium paid by buyers in the seller’s market for businesses over the past few years. It pays “literally” to consider exiting when there is strong demand and favorable conditions for acquiring businesses.

How to Get Started

PGP Advisory suggests beginning the process with properly setting up your business’ documentation. Are your company’s leases and agreements current, secure and available? Insider Tip – Whenever you renegotiate your lease agreement, consider asking the landlord to agree to subordinate if you (or a buyer) decide to seek bank financing. Be sure your business’ financials are in order, are your Profit and Loss Statements, Balance Sheets, and tax returns accurate, easily accessible, and showing positive trends? We also recommend giving serious thought to your company’s systems and procedures- do you have an operational playbook? Take a look at your role within your company and reduce the need for you to be involved on a daily basis as you can delegate to adequate and well-trained staff.

Takeaways

Owners who adopt a prepared mindset receive the dual benefit of a business with higher value to any external buyer, as well as enhanced profits regardless of whether a sale ever occurs. Being ready for a sale, means making your business more attractive to an outside investor and means your business is more prepared for any eventuality outside of your control that may force you into sale. These tips will help you keep your operations in excellent shape, and they will help your company be more nimble and adaptive to change with a stronger foundation to stand on.

Check out the link below to…

Explore Tax and Cost Savings Opportunity

How Can You Tell If a Potential Buyer is Really Serious?

When you’re trying to sell your business, the last thing you want is to waste time dealing with buyers who aren’t qualified and are unlikely to actually make a purchase. After all, you will not want to reveal details about your business to someone who may be looking to take advantage of the situation. Let’s take a closer look at how you can weed out legitimate buyers from those who are just kicking the can down the road.

Legitimate buyers will ask the right questions. They will have a keen interest in your industry and are seeking to gain more information. They will also be likely to ask intelligent probing questions about your customer base and the strengths and weaknesses of your business.

The best buyers will also ask logistical questions about your inventory and cash flow. It goes without saying they will want to know details about profits that are generated. Real buyers will also be concerned about wages and salaries. Their goal will be to ensure that your employees are taken care of and will be unlikely to quit.

Another area that you can expect serious buyers to ask about is capital expenditures. They will evaluate any equipment and machines involved in the business. They will also likely inquire about inventory that is unusable due to the fact that it is outdated or problematic. After all, if they are truly planning to buy the business, they would inherit any headaches.

A good rule of thumb is to imagine yourself in the shoes of the prospective buyer. What kinds of questions would you ask? If you find that a buyer is only asking the bare minimum of questions that only scratch the surface, odds are that they are not really interested. You can expect the legitimate buyer to ask about everything from environmental concerns to details about your competitors.

The best way to evaluate buyers is to turn to the experts. Your Business Broker or M&A Advisor will have years of experience in talking to buyers and will have a leg up on evaluating who is worth your time and energy.

Further, you would likely be overwhelmed with the process of handling buyer inquiries while you are still trying to effectively run and manage your business. A good brokerage professional will handle your incoming inquiries and only notify you of buyers who are suitable, qualified candidates. They will ensure that the highest standards of confidentiality are held along the way.

Copyright: Business Brokerage Press, Inc.

The post How Can You Tell If a Potential Buyer is Really Serious? appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

Celebrate 2021 & Look Ahead to 2022 With PGP Advisory

Taking Your Business to the Next Level

We unlock value for owners by helping you prepare for and successfully sell your business. We guide entrepreneurs through the exit process from evaluating options through closing the transaction. PGP Advisory also advises individuals and businesses seeking to grow through acquisition. We are an M&A Advisory firm and Business Broker in San Antonio who works with clients of various sizes across a wide range of industries and geographies. We are excited to support your 2022 exit or acquisition goals!

Looking Back on 2021

Thank you for your contribution toward our success last year. Here’s a summary of what we accomplished:

Crushed Goals in 2021

- Software Consulting Firm Acquisition (Sell-Side Advisor)

- FedEx Trucking Acquisition (Buy-side Advisor)

- Kickboxing Gym Acquisition (Sell-side Broker)

- Flower Store Acquisition (Sell-side Broker)

Total Closed Deal Value: $2.3M

Increased Our Scope

- Executed a strategic partnership with Transworld Business Advisors of Atlanta Peachtree to provide brokerage services in the Georgia market.

- In negotiations with a strategic partner to support M&A Advisory work in Charlotte, NC.

- Working with a partner who assesses business cost-out opportunities. Click here to learn more.

We Remain Committed to:

- Supporting clients through successful merger and acquisition transactions.

- Educating and preparing business owners for successful exits.

- Connecting owners with the resources to increase cash flow and the value of their businesses.

Hyper-Focused on Challenges Ahead

PGP Advisory is here to help you navigate the M&A landscape in the face of obstacles, such as:

- Talent retention in a tight labor market.

- Product availability during supply chain disruptions.

- Input costs and margins in an inflationary environment.

- Debt levels, capital investments, and available deal capital amidst rising interest rates.

Your Business Journey

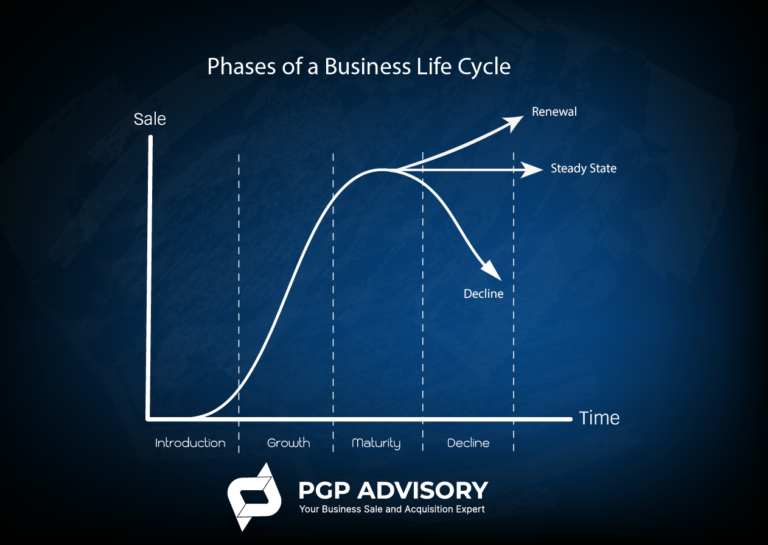

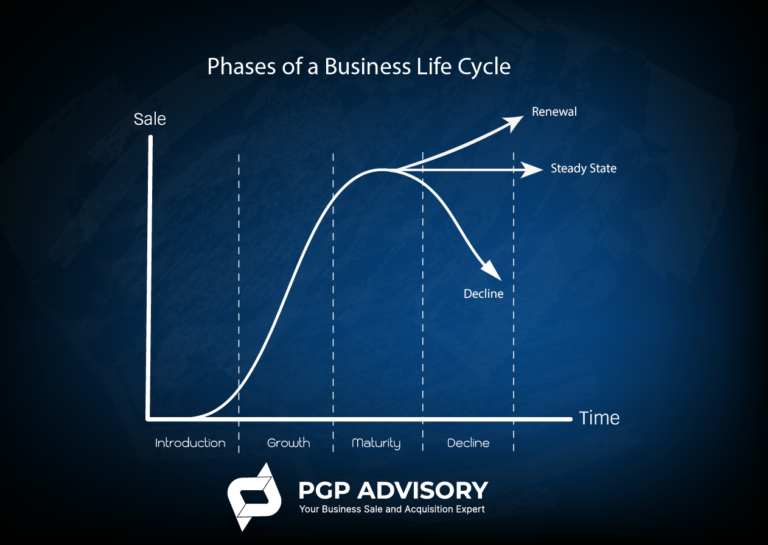

Regardless of where you are in your business journey (growth, maturity, exit), it’s important to focus on increasing the value of your business (i.e. growing operational cash flow). It is the lifeblood for growth, the discretionary income to support personal expenses, retirement, etc., and the driver of your business’ exit value.

Can you identify where your business lands in the life cycle chart?

More in Store for 2022

Be on the lookout for more content from us. PGP Advisory will continue to keep you informed on trends, information and challenges that impact your business. Let our team of trusted advisors help you crush your business goals this year and beyond.

Interested in learning more about the sale process? Download a free white paper here.

Schedule a consultation for your business valuation here.

Read More

What is Your Big Why?

Several years into my career, I realized it was increasingly daunting to live according to my values across what felt like the increasingly independent worlds of a corporate career, family, and community. I took some time to reflect and draft a Life Plan with an aspiration to align the various dimensions of my life to a central life’s mission-

“To be a living testimony to the glory of God by transforming the lives of others while continually striving to be the best man I can be.”

The mission encapsulated my intentions around daily choices on what was important, the types of quality of interactions with others, and served as a north star when faced with conflicting or tough decisions. It became my Big Why? Did my actions today positively impact others or improve me? In the years that followed, I was amazed at how consistent focus on a concept caused it to manifest in my life.

Six years ago, the demands of two young children and a dual career household propelled me into entrepreneurship and PGP Advisory was born. Although it wasn’t planned, the change put me on a pathway to align my priorities, gain greater autonomy over my time, and increase the transformative impact. I created more value for clients while being present for my kids during their formative years. I wanted to be an entrepreneur from my first entrepreneurial program at MIT in High School. The pathway to this destination was not linear, predictable, or easy. The Big Why helped me connect the dots between a Mechanical Engineering degree, an MBA, and a breadth of business experiences with a fulfilling profession.

Why is the Big Why important for you in a business transaction? It ultimately drives the priorities around the outcomes and informs the business transaction strategy. If a seller is unclear about what’s next for her or him, it is more difficult to make trade-offs in a deal. The strategy helps define sources of value and uncovers the win-win-win scenarios for a seller, buyer, and the business- an important tool when navigating the minefield of issues that can kill a deal. Here are some of the Big Why’s from previous clients:

- A client moved to their desired destination and started a new business with the deal proceeds

- A client pursued a new career in healthcare after sale of their business

- A client was able to retire and enjoy free time with family

- A client was able to secure the financial future of his family and focus on aspects of work that were most fulfilling

- A client acquired a business to run and grow as part of the long-term strategy towards wealth creation for his family

Not only did my clients in these deals win, but the businesses won also. They buyers all had sound strategies to improve and grow these businesses which is good for them, employees, customers, the community, etc. The deals supported everyone’s pursuit of her/his own personal Big Why.

Deals are ultimately about people and positive outcomes. I get to bring all of me to work every day in an effort to transform the lives of my clients and in the process live out my life’s purpose.

Read MorePGP Advisory’s Software Implementation Client- Westward Consulting- Completes Sale

PGP Advisory, a leading mergers and acquisition advisory practice and San Antonio business broker, is pleased to announce that it served as the exclusive M&A advisor to Westward Consulting LLC, a strategic Ultimate Kronos Group workforce software implementation partner, in its sale to Mosaic Consulting Group on July 1. With this acquisition, Mosaic Consulting Group, a long-time Ultimate Software partner focused on human capital management (HCM) support and service, is adding Westward Consulting’s Kronos experience and focus on workforce management, to their services.

“We worked with John West, Founder and CEO of Westward, over the past few years to prepare his company for this significant milestone. The cultural fit of the combined organization paired with enhanced solutions offerings into the marketplace position Mosaic to create and deliver increased value to its clients, employees, and partners.” Jason Brown, Managing Partner, PGP Advisory

John West, Westward CEO adds, “This is an exciting time. Two best-in-class teams are coming together to offer a full suite of services to our clients. Now, we will be able to help our clients seamlessly optimize and hone their team related strategy, processes and technologies”

Westward Consulting was founded in 2015 as a workforce consulting company with a mission that guides organizations to exceptional workforce performance. The Westward team exemplifies their team’s values: Family, Ethical, Fun and Generous. They deliver an exceptional client experience by focusing on thinking outside the box. Finding innovative solutions for their clients is at their core.

About PGP Advisory

PGP Advisory is a M&A advisory firm that helps our clients create value in the transaction process by offering Fortune 500 experience, tools, and strategies to small and midsized businesses. We seek out, identify, and solve problems for our clients throughout the entire transaction process. We leverage both our deal and operational expertise and experience to support our clients’ desired deal outcomes.