PGP Advisory’s Business Beat – December 2023

Entrepreneur’s Corner: Why You Should Address Your Company’s Weaknesses Head On

It is easy to get consumed with the urgent issues in our business. Carve out time each day, week, month, to “work on the business”. This investment of time will ultimately position your business to deliver the long-term results that are most important to you.

“SWOT”- Strengths, Weaknesses, Opportunities, and Threats- analysis is an important tool to help set direction for your business. Identify and fix the root causes of these issues will result in a stronger business that will pay dividends for you (time/profit), your customers(improved service), and employees (greater satisfaction).

SiriusXM’s The Reecie Colbert Show Interview with Entrepreneur Jason Brown

Jason Brown, Managing Partner of PGP Advisory, stopped by The Reecie Colbert Show to share his expertise with aspiring and current entrepreneurs.

Learn how PGP Advisory helps business owners:

- – Understand and achieve their goals.

- – Prepare for the inevitable reality- Everyone will eventually exit their business. The only question is on whose terms.

Life and business is about ideas. Successful entrepreneurs seek out new ideas and constantly learn, adapt, and grow.

Click Here to Listen to the Podcast!

The Importance of Developing Sales Forecasts

PGP Advisory attended the North San Antonio Chamber Coffee and Conversations at Magnolia Pancake Haus featured LindaRatner, an accomplished business owner, master coach, and sought-after speaker.

Linda shared the importance of developing a sales forecast in your business. Linda’s work prepares business owners to achieve their desired exit valuations.

Key takeaways:

- In business, Cash is King/Queen.

- To get a true picture of the business’s cash flow, entrepreneurs need to understand all three financial statements. Can you name them?

- Use data to determine what changes will have the biggest impact on your business. The outcome may surprise you.

Learn More About the North Chamber of San Antonio

Active Business Listings

Are you searching for a business to buy? Join PGP Advisory’s exclusive network to receive regular alerts on businesses available for sale. You’ll be the first to know about new opportunities. Receive our Active Business Alerts by subscribing via the link below! Check out a snapshot of our current inventory:

Profitable Home Care Services Franchise with Motivated Seller Deal

Price: $175,000

Cash Flow: $147,372

Location: League City, TX

Profitable Boutique Fitness Gym with Integrated Smart Gym Tech. Deal

Price: $350,000

Cash Flow: $80,000

Location: San Antonio, TX

Unique Mexican Ice Cream Retailer with Big Growth Potential

Price: $100,000

Cash Flow: $75,000

Location: San Antonio, TX

Ride Share Tech Platform Acquisition Opportunity

Price: N/A

Total Sales: $1,344,000

Location: Southeast U.S.

Vertically Integrated U.S. Paper Mill with a Focus Sustainability

Price: N/A

Total Sales: $2,500,000

Location: Central U.S.

Subscribe to PGP Advisory’s Active Business Alerts

PGP Advisory Announces Sale of Revered Adult Day Care Center

PGP Advisory is proud to announce the sale of an established Adult Day Care Center in McAllen, TX to a private buyer with ties to the local community. This transaction marks not only a successful business transfer but also an opportunity to build upon the exceptional care and support for adult populations and their families in the McAllen community.

This adult care center has served the community with compassionate care for many years, providing a nurturing and engaging environment for adults requiring day care. The acquiring team brings complimentary experience in education, business, and a strong their local presence with a shared commitment to the center’s values and mission. The buyers intend to build upon the facility’s rich legacy, expand its reach, and continue to positively impact lives.

Deal highlights:

- – Management team in place

- – Strong post-COVID rebound in clientele

- – The acquiring team brings complimentary experience in education, business, and a strong their local presence

Be the first to read the latest edition of PGP Advisory’s Business Beat by subscribing to our publications. Click here to opt-in!

Valuation. Strategy. Results.

At PGP Advisory, we always emphasize the significance of valuation. Even if you have no plans to sell, intentionally adding value is one of the best ways to strengthen your business and protect yourself from unforeseen events. We work with clients in San Antonio, Austin, Atlanta and beyond. No matter where your business is located, life throws curve balls. Our experienced team of professional business brokers in San Antonio, knows what buyers look for in a business. The factors that result in a premium sale price are inherently good for day-to-day business. Our unique advisory service starts with a valuation and business analysis. We identify strengths and weaknesses, then we develop a realistic strategy designed to add value, streamline operations, reduce owner dependency, and increase profitability. We draw on academia, years of experience, and a deep understanding of what makes a well-rounded business broker in San Antonio. Implementing best practices early will result in a more efficient and profitable business that is ready to sell when the time is right. By planning in advance you are much more likely to achieve your financial goals.

- We offer a free automated valuation to get started. You will receive a broad perspective on your business’s potential value. Click here to proceed.

- Click here to schedule your free custom consultation. During this meeting, we’ll be able to provide more comprehensive insights about your business and its current worth.

- PGP Advisory also offers a more robust and detailed valuation model. Click here if you’d like to get started with a more in-depth business valuation that takes into account additional factors, such as your market.

Business valuations can highlight strengths and weaknesses, and expose opportunities for improvements to add value. Many of our San Antonio, Austin and Atlanta clients use their business valuation results to build and help locate new opportunities. Contact us today if you would like to discuss setting up your valuation and the most appropriate option for you.

Read More

Must-Have Value Drivers for a Successful Business

How to Increase Your Business Value Using Value Drivers

Value drivers are characteristics of a business that either reduce the risk associated with owning the business or enhance the prospect that the business will grow significantly in the future. Every business owner should consider these essential factors to increase cash flow, as well as reduce risk, thus enhancing the overall value of the company.

An ongoing assessment of your business’ value drivers is integral to success. Profitability is hugely important, but implementing valuation drivers can result premiums. The valuation process involves an assessment of the company that should be part of any owner’s standard operating procedure, providing meaningful, actionable information highlighting the intrinsic value of your business and ultimately maximize returns.

Top Factors that Increase the Value of Your Business

PGP Advisory recommends incorporating these top seven factors that drive business value beyond revenue.

7 Drivers of Business Value

- Financial Performance – Know your numbers and keep good books and records! Both are critical inputs to operating your business, securing a bank loan to finance growth, sale of your business, and a range of other scenarios. The balance sheet- assets, liabilities, and equity positions- is an indicator of the future health of your company. The profit and loss and cash flow statements indicate the company’s profitability and the sources/uses of cash in the business. A company’s ownership, bookkeeper, and accountant work together to ensure that the financials statements accurately reflect the financial performance of the company. The financial statements tell the “real story” about performance. They give you, as the owner, the data you need to evaluate how much cash your business generates today and a means to assess progress toward your financial goals over time.

- Unique Product and Service Offering – An important factor in company value is your mix of products or services that you offer. Identify what makes your product and service offering unique. It gives you a designated place in the market with a very specific customer base, which is great. But, at the same time, be aware that a lack of diversification can create too much dependence on limited markets and industry shifts. Key customers may seek out suppliers who offer a range of products that benefit them. Increasing diversification and vertical or horizontal integration lowers risk, which boosts value.

- Solid Customer Base – Having a customer base that is established, loyal and widespread is important for the continuing viability of a company. As you grow your businesses, be intentional about not putting all your proverbial eggs into the basket of a few customers. This creates a dependency that in the best case reduces your ability to negotiate favorable terms and in the worst case can result a catastrophic loss of revenue. Successful businesses do not try to be everything to every customer. In your strategic plans, identify the customers and customer segments where you want to grow. Be intentional with growth across different customers and customer segments that see value in your offering and that you can serve profitably.

- Talent – Can your business run without you for several weeks? Are you involved in day-to-day tactical execution? Skilled human capital is vital for any organization. A business with strong leadership and a capable team are more valuable to the existing (and future) owner. Company employees contribute skills, creative abilities, experience, and knowledge to the business as well as the health of the company’s culture. They significantly reduce the risk and reliance of the business of the owner, freeing up time to focus on growth or other interests and supports a smoother transition for the next owner when the time comes.

- Technology – Technology enables efficient ways to connect with customers and clients. It makes the business adaptable. Invest in technology that help you better understand and serve the ever-changing needs of your customers. It can also drive operational efficiencies in all aspects of the business, driving down costs and facilitating growth.

- Sales and Marketing Strategy – Marketing refers to the link between the needs of customers and their response to the products or services of a company. A company with strong branding will improve its sales through an increase in market recognition and also give it a clear direction that helps enhance operational efficiency. A company should tie its brand to its mission and strategy direction and be aware of its sales and marketing shortcomings and capabilities. Word of mouth is not a marketing strategy. Be intentional in your efforts to communicate your unique offering to your target market of customers. Over the lifetime of every business, customers will come and go. A strong Sales and Marketing strategy is necessary to sustain and grow enterprises over time.

- Strategic Vision – Strategy involves a choice of how your company will compete in the market place. The company’s management needs to develop a good understanding of the impact of economic factors on their industry, their market share and market position, and their unique and niche offering. The people, processes, technology, marketing approach, financing, etc. should be organized to position your company to win in the marketplace. Focus on who you want to serve, how you want to serve them, and how you do that profitability. Strategy is not a presentation that sits on a shelf, but a living approach to how your company plans to succeed in the years to come.

Understanding Valuation Drivers – Key Takeaways

For your company to remain successful, you should always be monitoring the health of your key value drivers. Value drivers will make a business seem better than its competitors’. By creating as many value drivers as possible, a company can boost its leverage on the marketplace.

Check out these additional resources regarding value drivers:

Employee Retention Credit Info

Drive Your Profitability Through Cost Reductions

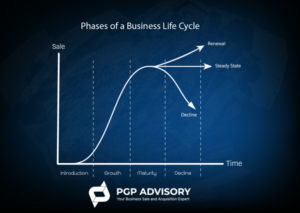

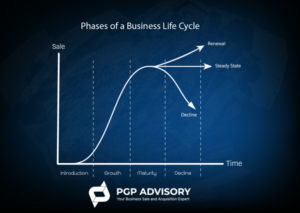

PGP Advisory remains steadfastly committed to guide you through your business journey for 2022 and beyond. No matter which phase of the business life cycle you find yourself. If you would like to explore more options for growing your business in the San Antonio, Georgia or North Carolina area, our M&A experts and business brokers at PGP Advisory are here to help.

Can you identify where your business lands in the life cycle chart?

More to come in the upcoming months to help you navigate challenges and circumstances your business may encounter.

Ready to explore your growth options or perhaps discuss your exit strategy? Contact PGP Advisory Today.

PGP Advisory is a full-service business brokerage and M&A advisory firm and a leader in business sales & acquisitions. PGP Advisory specializes in the CONFIDENTIAL sale of privately-owned businesses in a wide range of industries. Our business advisors are highly respected, experienced advisors who are recognized as some of the top deal makers in the business brokerage and M&A industry. We serve business owners throughout the San Antonio and Austin, Texas areas, as well as Atlanta, GA and Charlotte, NC.

Our M&A advisors and experienced business brokers have first-hand experience dealing with the challenges and opportunities of owning, selling, or merging a business. These qualities are what drive us toward continued excellence and set us apart from the competition.

Are you ready for a free confidential valuation? Your initial business valuations serve as a benchmark toward your next steps.

Click here for more information.

San Antonio | Austin | Atlanta | Charlotte

Read More

How Can You Tell If a Potential Buyer is Really Serious?

When you’re trying to sell your business, the last thing you want is to waste time dealing with buyers who aren’t qualified and are unlikely to actually make a purchase. After all, you will not want to reveal details about your business to someone who may be looking to take advantage of the situation. Let’s take a closer look at how you can weed out legitimate buyers from those who are just kicking the can down the road.

Legitimate buyers will ask the right questions. They will have a keen interest in your industry and are seeking to gain more information. They will also be likely to ask intelligent probing questions about your customer base and the strengths and weaknesses of your business.

The best buyers will also ask logistical questions about your inventory and cash flow. It goes without saying they will want to know details about profits that are generated. Real buyers will also be concerned about wages and salaries. Their goal will be to ensure that your employees are taken care of and will be unlikely to quit.

Another area that you can expect serious buyers to ask about is capital expenditures. They will evaluate any equipment and machines involved in the business. They will also likely inquire about inventory that is unusable due to the fact that it is outdated or problematic. After all, if they are truly planning to buy the business, they would inherit any headaches.

A good rule of thumb is to imagine yourself in the shoes of the prospective buyer. What kinds of questions would you ask? If you find that a buyer is only asking the bare minimum of questions that only scratch the surface, odds are that they are not really interested. You can expect the legitimate buyer to ask about everything from environmental concerns to details about your competitors.

The best way to evaluate buyers is to turn to the experts. Your Business Broker or M&A Advisor will have years of experience in talking to buyers and will have a leg up on evaluating who is worth your time and energy.

Further, you would likely be overwhelmed with the process of handling buyer inquiries while you are still trying to effectively run and manage your business. A good brokerage professional will handle your incoming inquiries and only notify you of buyers who are suitable, qualified candidates. They will ensure that the highest standards of confidentiality are held along the way.

Copyright: Business Brokerage Press, Inc.

The post How Can You Tell If a Potential Buyer is Really Serious? appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

How Does Your Business Compare?

When considering the value of your company, there are basic value drivers. While it is difficult to place a specific value on them, one can take a look and make a “ballpark” judgment on each. How does your company look?

| Value Driver | Low | Medium | High |

|---|---|---|---|

| Business Type | Little Demand | Some Demand | High Demand |

| Business Growth | Low | Steady | High & Steady |

| Market Share | Small | Steady Growth | Large & Growing |

| Profits | Unsteady | Consistent | Good & Steady |

| Management | Under Staffed | Okay | Above Average |

| Financials | Compiled | Reviewed | Audited |

| Customer Base | Not Steady | Fairly Steady | Wide & Growing |

| Litigation | Some | Occasionally | None in Years |

| Sales | No Growth | Some Growth | Good Growth |

| Industry Trend | Okay | Some Growth | Good Growth |

The possible value drivers are almost endless, but a close look at the ones above should give you some idea of where your business stands. Don’t just compare against businesses in general, but specifically consider the competition.

As part of your overall exit strategy, what can you do to improve your company?

© Copyright 2015 Business Brokerage Press, Inc.

Photo Credit: kconnors via morgueFile