Guide To Selling Your Business & Building Your Transition Team

“I’m not ready to sell now. I’ve got several years left.” A key follow-up question to ask yourself is: “Is now the right time to sell?” As the Fed continues to raise rates to combat inflation and the risk of recession looms on the horizon, how will your business fair in this environment? We encourage you to consider these external factors when weighing whether or not this is the right time to sell.

Hopefully you’ve read PGP Advisory’s article, “What to Expect When You’re Ready To Sell,” which highlights the preparation timeline and how to set realistic goals for the process.

The team at PGP Advisory has formed a step-by-step guide to ensure businesses are sold at the right time, for the right price, and to the right buyer.

Step 1: Be Informed

Do your research and educate yourself on the selling process. Consult with an M&A advisor.

An M&A advisor will help you establish a strategy tailored to your business and manage the complexities of the sale process so that you can stay focused on running your business. They’ll identify and qualify buyers, secure an offer(s), and negotiate the eventual sale with the best possible terms.

If you’re invested in selling your business for the best possible value, choose a leading M&A advisory firm to broker the deal.

Step 2: Get Your Finances in Order

Purchase price is important, but so are the terms on the deal. Accurate financials can make the difference between getting 80-90% of the purchase price at close (via bank financing) and you becoming the bank (in the form of seller financing) for a significant portion of the purchase price over several years.

Do your due diligence by organizing your bookkeeping and financials and getting ahead of items that could prevent bank financing or slow down the sale (such as sign-off from other shareholders or active lawsuits or legal proceedings).

Consider your business’ employee contracts, intellectual property issues, and federal and state tax requirements. To ensure you have time to fix all potential red flags, hire a third-party accounting firm to assess your financial statements and advise on an exit-friendly tax strategy a year or two before the sale.

Step 3: Get a Business Valuation

Turn to experts (e.g., business brokers, M&A advisors) to understand how much your company is worth and to whom. Value is more than a number on a paper. The value that matters is what a buyer is willing to pay for your business. A trusted advisor will help establish a range that you would expect a reasonable buyer to offer for the business.

Step 4: Build Your Transition Team

“Great things in business are never done by one person, they’re done by a team of people.” – Steve Jobs. Putting together a team early can prevent a lot of stumbling down the road. Here is our list of professionals that business owners should have on their team (before your business goes to market) to smoothly and successfully sell their business:

1) M&A Advisor – Expert on sale strategy and process

2) CPA – Expert on your financials and tax strategies

3) Lawyer – Expert on identifying and managing legal risks with both the business and sale

4) Financial Advisor – Expert on planning for post-sale impact on your overall financial objectives

Summary

As experienced M&A Advisors, we are at the center of your business sale transition team. If the issues are not unaddressed, you will spend valuable time and resources prior to and after the sale trying to “fix” things. Your business is likely your most valuable asset, and building a successful company can take years of time and effort. If you’re considering selling your business at some point, schedule some time to discuss how we can help you make an informed decision – and maximize the price you receive for the sale.

Valuation. Strategy. Results.

At PGP Advisory, we always emphasize the significance of valuation. Even if you have no plans to sell, intentionally adding value is one of the best ways to strengthen your business and protect yourself from unforeseen events. We work with clients in San Antonio, Austin, Atlanta and beyond. No matter where your business is located, life throws curve balls. Our experienced team of professional business brokers in San Antonio, knows what buyers look for in a business. The factors that result in a premium sale price are inherently good for day-to-day business. Our unique advisory service starts with a valuation and business analysis. We identify strengths and weaknesses, then we develop a realistic strategy designed to add value, streamline operations, reduce owner dependency, and increase profitability. We draw on academia, years of experience, and a deep understanding of what makes a well-rounded business broker in San Antonio. Implementing best practices early will result in a more efficient and profitable business that is ready to sell when the time is right. By planning in advance you are much more likely to achieve your financial goals.

- We offer a free automated valuation to get started. You will receive a broad perspective on your business’s potential value. Click here to proceed.

- Click here to schedule your free custom consultation. During this meeting, we’ll be able to provide more comprehensive insights about your business and its current worth.

- PGP Advisory also offers a more robust and detailed valuation model. Click here if you’d like to get started with a more in-depth business valuation that takes into account additional factors, such as your market.

Business valuations can highlight strengths and weaknesses, and expose opportunities for improvements to add value. Many of our San Antonio, Austin and Atlanta clients use their business valuation results to build and help locate new opportunities. Contact us today if you would like to discuss setting up your valuation and the most appropriate option for you.

Read More

Must-Have Value Drivers for a Successful Business

How to Increase Your Business Value Using Value Drivers

Value drivers are characteristics of a business that either reduce the risk associated with owning the business or enhance the prospect that the business will grow significantly in the future. Every business owner should consider these essential factors to increase cash flow, as well as reduce risk, thus enhancing the overall value of the company.

An ongoing assessment of your business’ value drivers is integral to success. Profitability is hugely important, but implementing valuation drivers can result premiums. The valuation process involves an assessment of the company that should be part of any owner’s standard operating procedure, providing meaningful, actionable information highlighting the intrinsic value of your business and ultimately maximize returns.

Top Factors that Increase the Value of Your Business

PGP Advisory recommends incorporating these top seven factors that drive business value beyond revenue.

7 Drivers of Business Value

- Financial Performance – Know your numbers and keep good books and records! Both are critical inputs to operating your business, securing a bank loan to finance growth, sale of your business, and a range of other scenarios. The balance sheet- assets, liabilities, and equity positions- is an indicator of the future health of your company. The profit and loss and cash flow statements indicate the company’s profitability and the sources/uses of cash in the business. A company’s ownership, bookkeeper, and accountant work together to ensure that the financials statements accurately reflect the financial performance of the company. The financial statements tell the “real story” about performance. They give you, as the owner, the data you need to evaluate how much cash your business generates today and a means to assess progress toward your financial goals over time.

- Unique Product and Service Offering – An important factor in company value is your mix of products or services that you offer. Identify what makes your product and service offering unique. It gives you a designated place in the market with a very specific customer base, which is great. But, at the same time, be aware that a lack of diversification can create too much dependence on limited markets and industry shifts. Key customers may seek out suppliers who offer a range of products that benefit them. Increasing diversification and vertical or horizontal integration lowers risk, which boosts value.

- Solid Customer Base – Having a customer base that is established, loyal and widespread is important for the continuing viability of a company. As you grow your businesses, be intentional about not putting all your proverbial eggs into the basket of a few customers. This creates a dependency that in the best case reduces your ability to negotiate favorable terms and in the worst case can result a catastrophic loss of revenue. Successful businesses do not try to be everything to every customer. In your strategic plans, identify the customers and customer segments where you want to grow. Be intentional with growth across different customers and customer segments that see value in your offering and that you can serve profitably.

- Talent – Can your business run without you for several weeks? Are you involved in day-to-day tactical execution? Skilled human capital is vital for any organization. A business with strong leadership and a capable team are more valuable to the existing (and future) owner. Company employees contribute skills, creative abilities, experience, and knowledge to the business as well as the health of the company’s culture. They significantly reduce the risk and reliance of the business of the owner, freeing up time to focus on growth or other interests and supports a smoother transition for the next owner when the time comes.

- Technology – Technology enables efficient ways to connect with customers and clients. It makes the business adaptable. Invest in technology that help you better understand and serve the ever-changing needs of your customers. It can also drive operational efficiencies in all aspects of the business, driving down costs and facilitating growth.

- Sales and Marketing Strategy – Marketing refers to the link between the needs of customers and their response to the products or services of a company. A company with strong branding will improve its sales through an increase in market recognition and also give it a clear direction that helps enhance operational efficiency. A company should tie its brand to its mission and strategy direction and be aware of its sales and marketing shortcomings and capabilities. Word of mouth is not a marketing strategy. Be intentional in your efforts to communicate your unique offering to your target market of customers. Over the lifetime of every business, customers will come and go. A strong Sales and Marketing strategy is necessary to sustain and grow enterprises over time.

- Strategic Vision – Strategy involves a choice of how your company will compete in the market place. The company’s management needs to develop a good understanding of the impact of economic factors on their industry, their market share and market position, and their unique and niche offering. The people, processes, technology, marketing approach, financing, etc. should be organized to position your company to win in the marketplace. Focus on who you want to serve, how you want to serve them, and how you do that profitability. Strategy is not a presentation that sits on a shelf, but a living approach to how your company plans to succeed in the years to come.

Understanding Valuation Drivers – Key Takeaways

For your company to remain successful, you should always be monitoring the health of your key value drivers. Value drivers will make a business seem better than its competitors’. By creating as many value drivers as possible, a company can boost its leverage on the marketplace.

Check out these additional resources regarding value drivers:

Employee Retention Credit Info

Drive Your Profitability Through Cost Reductions

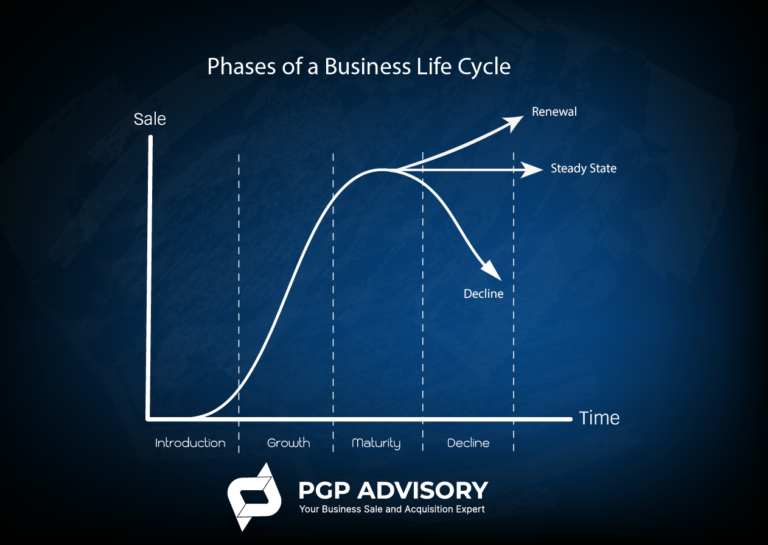

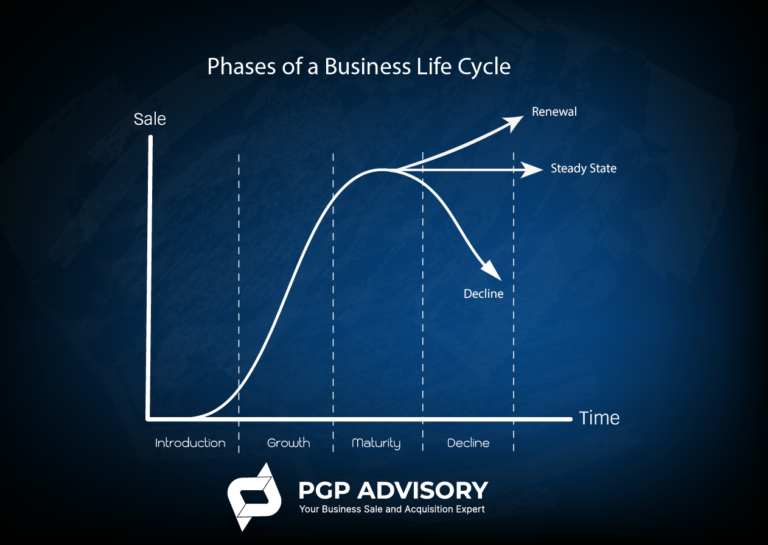

PGP Advisory remains steadfastly committed to guide you through your business journey for 2022 and beyond. No matter which phase of the business life cycle you find yourself. If you would like to explore more options for growing your business in the San Antonio, Georgia or North Carolina area, our M&A experts and business brokers at PGP Advisory are here to help.

Can you identify where your business lands in the life cycle chart?

More to come in the upcoming months to help you navigate challenges and circumstances your business may encounter.

Ready to explore your growth options or perhaps discuss your exit strategy? Contact PGP Advisory Today.

PGP Advisory is a full-service business brokerage and M&A advisory firm and a leader in business sales & acquisitions. PGP Advisory specializes in the CONFIDENTIAL sale of privately-owned businesses in a wide range of industries. Our business advisors are highly respected, experienced advisors who are recognized as some of the top deal makers in the business brokerage and M&A industry. We serve business owners throughout the San Antonio and Austin, Texas areas, as well as Atlanta, GA and Charlotte, NC.

Our M&A advisors and experienced business brokers have first-hand experience dealing with the challenges and opportunities of owning, selling, or merging a business. These qualities are what drive us toward continued excellence and set us apart from the competition.

Are you ready for a free confidential valuation? Your initial business valuations serve as a benchmark toward your next steps.

Click here for more information.

San Antonio | Austin | Atlanta | Charlotte

Read More

How Can You Tell If a Potential Buyer is Really Serious?

When you’re trying to sell your business, the last thing you want is to waste time dealing with buyers who aren’t qualified and are unlikely to actually make a purchase. After all, you will not want to reveal details about your business to someone who may be looking to take advantage of the situation. Let’s take a closer look at how you can weed out legitimate buyers from those who are just kicking the can down the road.

Legitimate buyers will ask the right questions. They will have a keen interest in your industry and are seeking to gain more information. They will also be likely to ask intelligent probing questions about your customer base and the strengths and weaknesses of your business.

The best buyers will also ask logistical questions about your inventory and cash flow. It goes without saying they will want to know details about profits that are generated. Real buyers will also be concerned about wages and salaries. Their goal will be to ensure that your employees are taken care of and will be unlikely to quit.

Another area that you can expect serious buyers to ask about is capital expenditures. They will evaluate any equipment and machines involved in the business. They will also likely inquire about inventory that is unusable due to the fact that it is outdated or problematic. After all, if they are truly planning to buy the business, they would inherit any headaches.

A good rule of thumb is to imagine yourself in the shoes of the prospective buyer. What kinds of questions would you ask? If you find that a buyer is only asking the bare minimum of questions that only scratch the surface, odds are that they are not really interested. You can expect the legitimate buyer to ask about everything from environmental concerns to details about your competitors.

The best way to evaluate buyers is to turn to the experts. Your Business Broker or M&A Advisor will have years of experience in talking to buyers and will have a leg up on evaluating who is worth your time and energy.

Further, you would likely be overwhelmed with the process of handling buyer inquiries while you are still trying to effectively run and manage your business. A good brokerage professional will handle your incoming inquiries and only notify you of buyers who are suitable, qualified candidates. They will ensure that the highest standards of confidentiality are held along the way.

Copyright: Business Brokerage Press, Inc.

The post How Can You Tell If a Potential Buyer is Really Serious? appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

Celebrate 2021 & Look Ahead to 2022 With PGP Advisory

Taking Your Business to the Next Level

We unlock value for owners by helping you prepare for and successfully sell your business. We guide entrepreneurs through the exit process from evaluating options through closing the transaction. PGP Advisory also advises individuals and businesses seeking to grow through acquisition. We are an M&A Advisory firm and Business Broker in San Antonio who works with clients of various sizes across a wide range of industries and geographies. We are excited to support your 2022 exit or acquisition goals!

Looking Back on 2021

Thank you for your contribution toward our success last year. Here’s a summary of what we accomplished:

Crushed Goals in 2021

- Software Consulting Firm Acquisition (Sell-Side Advisor)

- FedEx Trucking Acquisition (Buy-side Advisor)

- Kickboxing Gym Acquisition (Sell-side Broker)

- Flower Store Acquisition (Sell-side Broker)

Total Closed Deal Value: $2.3M

Increased Our Scope

- Executed a strategic partnership with Transworld Business Advisors of Atlanta Peachtree to provide brokerage services in the Georgia market.

- In negotiations with a strategic partner to support M&A Advisory work in Charlotte, NC.

- Working with a partner who assesses business cost-out opportunities. Click here to learn more.

We Remain Committed to:

- Supporting clients through successful merger and acquisition transactions.

- Educating and preparing business owners for successful exits.

- Connecting owners with the resources to increase cash flow and the value of their businesses.

Hyper-Focused on Challenges Ahead

PGP Advisory is here to help you navigate the M&A landscape in the face of obstacles, such as:

- Talent retention in a tight labor market.

- Product availability during supply chain disruptions.

- Input costs and margins in an inflationary environment.

- Debt levels, capital investments, and available deal capital amidst rising interest rates.

Your Business Journey

Regardless of where you are in your business journey (growth, maturity, exit), it’s important to focus on increasing the value of your business (i.e. growing operational cash flow). It is the lifeblood for growth, the discretionary income to support personal expenses, retirement, etc., and the driver of your business’ exit value.

Can you identify where your business lands in the life cycle chart?

More in Store for 2022

Be on the lookout for more content from us. PGP Advisory will continue to keep you informed on trends, information and challenges that impact your business. Let our team of trusted advisors help you crush your business goals this year and beyond.

Interested in learning more about the sale process? Download a free white paper here.

Schedule a consultation for your business valuation here.

Read More