Know Your Worth

A business valuation is the process of determining the fair value of an asset, investment, or firm. Knowing what an asset is worth and what determines that value is a pre-requisite for intelligent decision making.

Who Should Get a Valuation?

Owners

All owners should establish a baseline for their business and repeat periodically. A valuation serves as a wellness check for the health of your business.

Buyers

Buyers inform purchase price for target paying too much upfront can hinder long-term success.

Partners

Partners should understand the value of their company and their respective pieces. Informs exit options for the partners or company as a whole?

Life-Events (e.g. Divorce, Death, etc.)

Why Do I Need a Valuation?

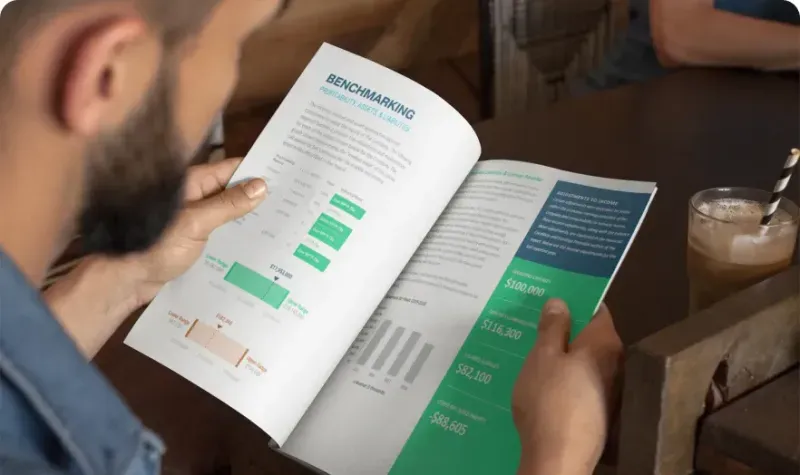

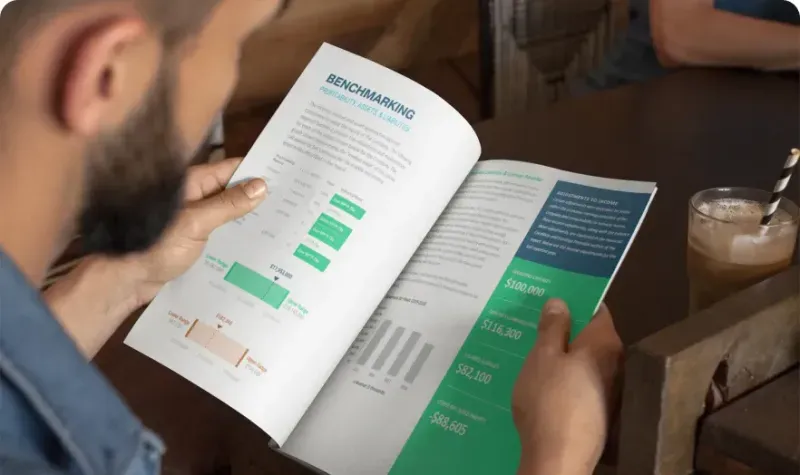

Cash Flow

Identify ways to generate more cash for your business. Learn where cash is coming from and going. See how you compare and where are the opportunities for improvement.

Growth

How do your target value? Establishing a baseline and goals gives the owner the tools to evaluate investment decisions along the way.

Plan for Retirement

Avoid the “trap” of finding out too late that you overestimated what your business is worth. Everyone will exit. Be prepared and positioned to support your long-term goals, money, time, legacy, etc.

Time

Transition from owner-operator to investor. Valuation identifies ways to gain control of your time while maximizing the value of your business.

How Can I Get Started on My Valuation?

PGP Advisory offers two types of valuations for your business.

Standard Valuation Report