Celebrate 2021 & Look Ahead to 2022 With PGP Advisory

Taking Your Business to the Next Level

We unlock value for owners by helping you prepare for and successfully sell your business. We guide entrepreneurs through the exit process from evaluating options through closing the transaction. PGP Advisory also advises individuals and businesses seeking to grow through acquisition. We are an M&A Advisory firm and Business Broker in San Antonio who works with clients of various sizes across a wide range of industries and geographies. We are excited to support your 2022 exit or acquisition goals!

Looking Back on 2021

Thank you for your contribution toward our success last year. Here’s a summary of what we accomplished:

Crushed Goals in 2021

- Software Consulting Firm Acquisition (Sell-Side Advisor)

- FedEx Trucking Acquisition (Buy-side Advisor)

- Kickboxing Gym Acquisition (Sell-side Broker)

- Flower Store Acquisition (Sell-side Broker)

Total Closed Deal Value: $2.3M

Increased Our Scope

- Executed a strategic partnership with Transworld Business Advisors of Atlanta Peachtree to provide brokerage services in the Georgia market.

- In negotiations with a strategic partner to support M&A Advisory work in Charlotte, NC.

- Working with a partner who assesses business cost-out opportunities. Click here to learn more.

We Remain Committed to:

- Supporting clients through successful merger and acquisition transactions.

- Educating and preparing business owners for successful exits.

- Connecting owners with the resources to increase cash flow and the value of their businesses.

Hyper-Focused on Challenges Ahead

PGP Advisory is here to help you navigate the M&A landscape in the face of obstacles, such as:

- Talent retention in a tight labor market.

- Product availability during supply chain disruptions.

- Input costs and margins in an inflationary environment.

- Debt levels, capital investments, and available deal capital amidst rising interest rates.

Your Business Journey

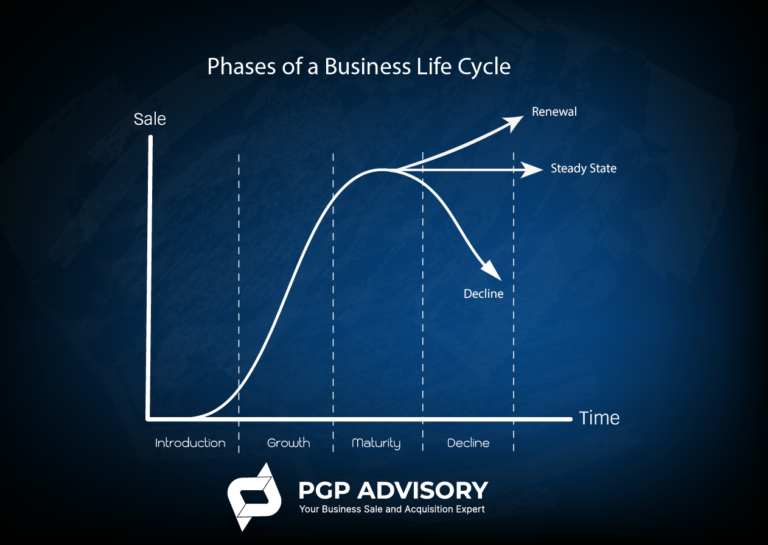

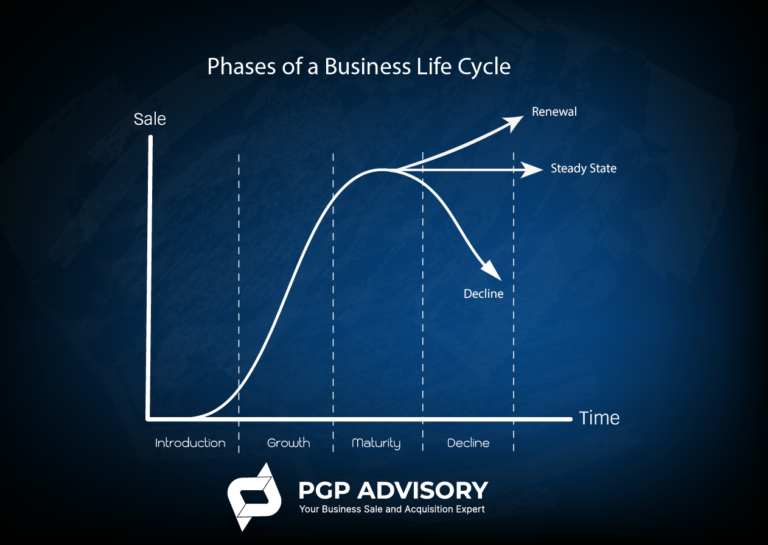

Regardless of where you are in your business journey (growth, maturity, exit), it’s important to focus on increasing the value of your business (i.e. growing operational cash flow). It is the lifeblood for growth, the discretionary income to support personal expenses, retirement, etc., and the driver of your business’ exit value.

Can you identify where your business lands in the life cycle chart?

More in Store for 2022

Be on the lookout for more content from us. PGP Advisory will continue to keep you informed on trends, information and challenges that impact your business. Let our team of trusted advisors help you crush your business goals this year and beyond.

Interested in learning more about the sale process? Download a free white paper here.

Schedule a consultation for your business valuation here.

Read More

What is Your Big Why?

Several years into my career, I realized it was increasingly daunting to live according to my values across what felt like the increasingly independent worlds of a corporate career, family, and community. I took some time to reflect and draft a Life Plan with an aspiration to align the various dimensions of my life to a central life’s mission-

“To be a living testimony to the glory of God by transforming the lives of others while continually striving to be the best man I can be.”

The mission encapsulated my intentions around daily choices on what was important, the types of quality of interactions with others, and served as a north star when faced with conflicting or tough decisions. It became my Big Why? Did my actions today positively impact others or improve me? In the years that followed, I was amazed at how consistent focus on a concept caused it to manifest in my life.

Six years ago, the demands of two young children and a dual career household propelled me into entrepreneurship and PGP Advisory was born. Although it wasn’t planned, the change put me on a pathway to align my priorities, gain greater autonomy over my time, and increase the transformative impact. I created more value for clients while being present for my kids during their formative years. I wanted to be an entrepreneur from my first entrepreneurial program at MIT in High School. The pathway to this destination was not linear, predictable, or easy. The Big Why helped me connect the dots between a Mechanical Engineering degree, an MBA, and a breadth of business experiences with a fulfilling profession.

Why is the Big Why important for you in a business transaction? It ultimately drives the priorities around the outcomes and informs the business transaction strategy. If a seller is unclear about what’s next for her or him, it is more difficult to make trade-offs in a deal. The strategy helps define sources of value and uncovers the win-win-win scenarios for a seller, buyer, and the business- an important tool when navigating the minefield of issues that can kill a deal. Here are some of the Big Why’s from previous clients:

- A client moved to their desired destination and started a new business with the deal proceeds

- A client pursued a new career in healthcare after sale of their business

- A client was able to retire and enjoy free time with family

- A client was able to secure the financial future of his family and focus on aspects of work that were most fulfilling

- A client acquired a business to run and grow as part of the long-term strategy towards wealth creation for his family

Not only did my clients in these deals win, but the businesses won also. They buyers all had sound strategies to improve and grow these businesses which is good for them, employees, customers, the community, etc. The deals supported everyone’s pursuit of her/his own personal Big Why.

Deals are ultimately about people and positive outcomes. I get to bring all of me to work every day in an effort to transform the lives of my clients and in the process live out my life’s purpose.

Read MorePGP Advisory’s Software Implementation Client- Westward Consulting- Completes Sale

PGP Advisory, a leading mergers and acquisition advisory practice and San Antonio business broker, is pleased to announce that it served as the exclusive M&A advisor to Westward Consulting LLC, a strategic Ultimate Kronos Group workforce software implementation partner, in its sale to Mosaic Consulting Group on July 1. With this acquisition, Mosaic Consulting Group, a long-time Ultimate Software partner focused on human capital management (HCM) support and service, is adding Westward Consulting’s Kronos experience and focus on workforce management, to their services.

“We worked with John West, Founder and CEO of Westward, over the past few years to prepare his company for this significant milestone. The cultural fit of the combined organization paired with enhanced solutions offerings into the marketplace position Mosaic to create and deliver increased value to its clients, employees, and partners.” Jason Brown, Managing Partner, PGP Advisory

John West, Westward CEO adds, “This is an exciting time. Two best-in-class teams are coming together to offer a full suite of services to our clients. Now, we will be able to help our clients seamlessly optimize and hone their team related strategy, processes and technologies”

Westward Consulting was founded in 2015 as a workforce consulting company with a mission that guides organizations to exceptional workforce performance. The Westward team exemplifies their team’s values: Family, Ethical, Fun and Generous. They deliver an exceptional client experience by focusing on thinking outside the box. Finding innovative solutions for their clients is at their core.

About PGP Advisory

PGP Advisory is a M&A advisory firm that helps our clients create value in the transaction process by offering Fortune 500 experience, tools, and strategies to small and midsized businesses. We seek out, identify, and solve problems for our clients throughout the entire transaction process. We leverage both our deal and operational expertise and experience to support our clients’ desired deal outcomes.

Strategic Planning Lesson from Game of Thrones

“Fight every battle, everywhere, always, in your mind. Everyone is your enemy, everyone is your friend, every possible series of events is happening all at once. Live that way and nothing will surprise you. Everything that happens will be something that you’ve seen before.” Petyr Baelish, Game of Thrones.

The Importance of Owner Flexibility

You shouldn’t expect to sell your company overnight. For every company that sells quickly, there are a hundred that take many months or even years to sell. Having the correct mindset and understanding of what you must do ahead of time to prepare for the sale of your company will help you avoid a range of headaches and dramatically increase your overall chances of success.

First, and arguably most importantly, you must have the right frame of mind. Flexibility is a key attribute for any business owner looking to sell his or her business. There are many variables involved in selling a business, and that means much can go wrong. An inflexible owner can even irritate prospective buyers and inadvertently sabotage what could have otherwise been a workable deal.

Be Flexible on Price

A key part of being flexible is to be ready and willing to accept a lower price. There are many reasons why business owners may fail to achieve the price they want for their business. These factors range from lack of management depth and lack of geographical distribution to an overreliance on a handful of customers or key clients. Of course, one way to address this problem is to work with a business broker or M&A advisor in advance, so that such price issues are minimized or eliminated altogether.

Be Prepared to Compromise

In the process of selling your business, you may want to achieve confidentiality and sell your business quickly and for the price you want. However, the fact is that most sellers find that it is possible to have confidentiality, speed, and the price you want, but not all three. Ultimately, you’ll have to pick two of the three variables that are most important to you.

Be Patient

A third way in which business owner flexibility can boost the chances of success is to embrace the virtue of patience. By accepting the fact that businesses can “sit on the shelf” for a considerable period of time, you are shifting your expectations. This realization can help reduce your stress level. The fact is that stressed out owners are far more likely to make mistakes.

Sometimes Losing is Really Winning

A fourth way in which business owners should be flexible is realizing that you and your lawyer will not win every single fight. There will be many points of contention, and a smart dealmaker realizes that it is often better to have a good deal than a perfect deal. You may have to make sacrifices in order to sell your company. Simply stated, you shouldn’t expect the other side to lose every point.

At the end of the day, a savvy business owner is one that never loses sight of the final goal. Your goal is to sell your business. Seeing the situation from the buyer’s perspective will help you make better decisions on how you present your business and interact with prospective buyers. Maintaining a flexible attitude with prospective buyers helps to position you as a reasonable person who wants to make a deal. Goodwill can go a long way when obstacles do arise.

Copyright: Business Brokerage Press, Inc.

The post The Importance of Owner Flexibility appeared first on Deal Studio – Automate, accelerate and elevate your deal making.